When a casino player wins an amount which is greater than the government defined minimums, certain information is required to be shared with the government. In these circumstances, the casino must collect this information from the player. This is usually done very soon after the player wins and by a "Floor" or "Cage" casino employee.

| Usually, the player is asked to provide a Taxpayer Identification Number (TIN). Usually, but not always, this is the player's Social Security Number. All TINs however, must be 9 digit numbers. |

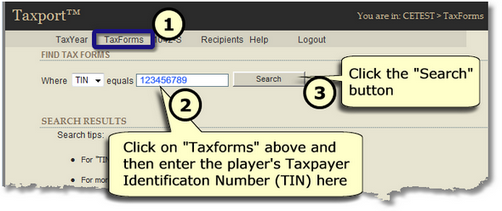

| Step 1: | With Taxport Casino open in a browser window (Internet Explorer® is the recommended browser), click on the upper "Taxforms" link as shown in the screen example below. |

| If the player is a foreigner, click on the "1042-S" link rather than the "Taxforms" link. Then choose the drop down option, "Lookup Forms". |

| Step 2: | In the box shown above, enter the Taxpayer Identification Number (TIN) that you have obtained from the player and click on the "Search" button (for 1042-S, you will usually enter the winner's Account Number). One of the following will then happen in Taxport Casino: |

![]() If the player has already been entered into Taxport (for instance, having previously had entered winnings at your casino), a new screen with key player information that is similar to the one below will appear. Below the key player information, this screen may also show information on existing tax form(s) that have already been generated for a given player.

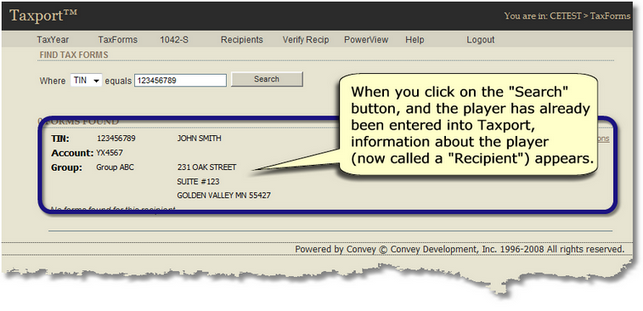

If the player has already been entered into Taxport (for instance, having previously had entered winnings at your casino), a new screen with key player information that is similar to the one below will appear. Below the key player information, this screen may also show information on existing tax form(s) that have already been generated for a given player.

| If necessary, you can make changes to this information by clicking on the "Edit" link found to the right of the player's name which will bring up the player information ("Recipient") screen. See the topic, "Entering Player Information". |

![]() If the player has NOT previously been entered into Taxport, a new screen that is similar to the one below will appear. If this screen appears, click on the "NEW RECIPIENT" link as shown in the example screen below and go directly to the topic, "Entering Player Information" to learn how to enter the required information for this player (now called a "Recipient").

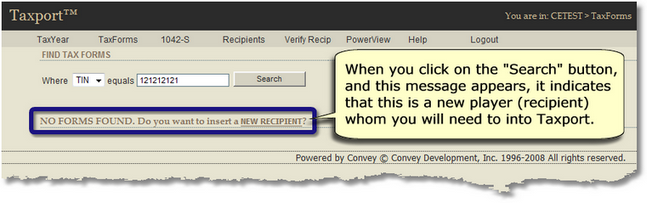

If the player has NOT previously been entered into Taxport, a new screen that is similar to the one below will appear. If this screen appears, click on the "NEW RECIPIENT" link as shown in the example screen below and go directly to the topic, "Entering Player Information" to learn how to enter the required information for this player (now called a "Recipient").

![]() found an existing player (Recipient).

found an existing player (Recipient).

or

![]() created a new one.

created a new one.

At this time, you can proceed to create the appropriate tax form that you must use to enter and record the player's winnings. Go directly to the topic, "Entering Win into Tax Form".