|

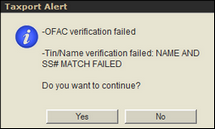

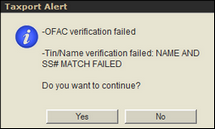

Any time after a player (Recipient) has been entered into Taxport, you will be able to associate and enter the appropriate tax form for that player's particular win type. In most cases, every distinct win needs to have a tax form entered for that win. The tax form is always associated with the players key information.

Tip: Tip: | See your casino's Taxport administrator or manager if you have questions on which form type is appropriate for the type of win that a given player reports. Form "W-2G" is used for most types of Casino winnings. |

| Step 1: | After entering player information, choose the appropriate form for the winning player using the "New Form" link as shown in the screen example below. A drop down menu appears to allow you to select the appropriate form type. |

| Step 2: | Select the appropriate form from the drop down list. You will then need to wait a few moments while Taxport Casino performs a TIN and OFAC Verification (not applicable to 1042-S foreigners). While waiting, you should not click on any other links (the status bar will indicate that Taxport is processing). |

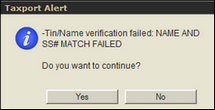

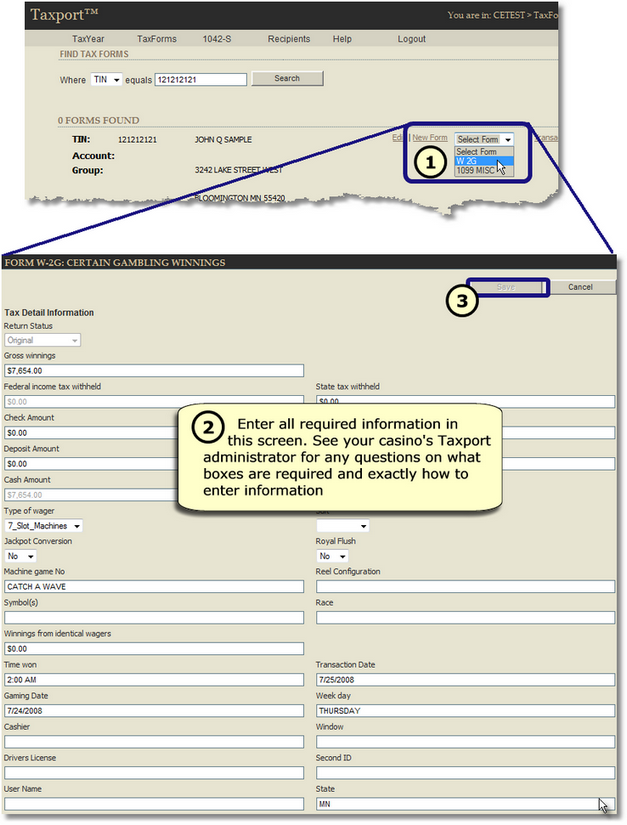

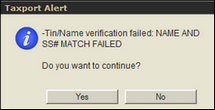

| Step 3: | After waiting a few moments, if you get a "Taxport Alert" message similar to the ones shown below, proceed to the topic, "TINs and OFAC Verification" before continuing on with Step 4 below. Otherwise, if a "Taxport Alert" is not displayed, proceed to Step 4 below.

|

| Step 4: | A new screen of the selected form type will display as shown in the screen example above (this one of a form type W-2G). Enter all required information in this screen. |

Tip: Tip: | See your casino's Taxport administrator or manager for any questions on what boxes are required and exactly how to enter information. |

Note: Note: | Some of the boxes will be automatically filled in for you as you enter values. This is because Taxport Casino automatically calculates the "Federal Income tax withheld" box based on government regulations and your casino's specific settings for Taxport Casino. You will also note that the winner's payout or "Cash Amount" is automatically determined. |

Note: Note: | If the data that you type into these fields contains non-compliant information, you may get an error message that will prompt you to re-type compliant information. For instance, if you try to enter a letter in a dollar amount field, you will receive an error message. |

| Step 5: | Click on the "Save" button. Then proceed to Step 6 below. |

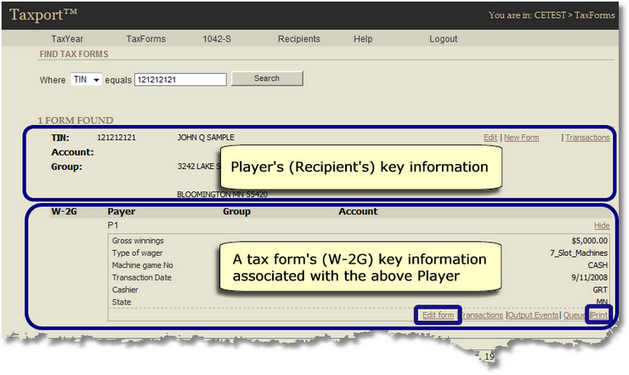

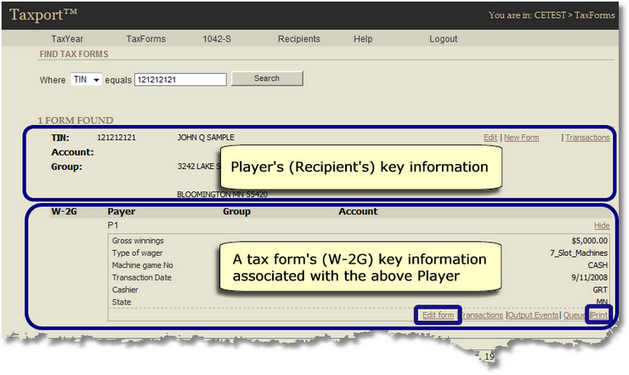

Note: Note: | You have now entered all the information required for a typical player win. You will note that when you enter any player's TIN in the future, not only does the player's key information (TIN, name, address, etc.) display, but key information on any associated tax form(s) is also displayed below the player's (Recipient's) key information. See the screen example below. |

| Step 6: | Depending on how your particular casino has setup Taxport Casino, either a tax form statement will now automatically print (to be given directly to the winning player) or you or your casino will be given the opportunity to print the tax form statement at a later time. See your casino's Taxport administrator or manager to follow the procedure used by your particular casino. |

Main Menu Main Menu

Home Menu Home Menu

|