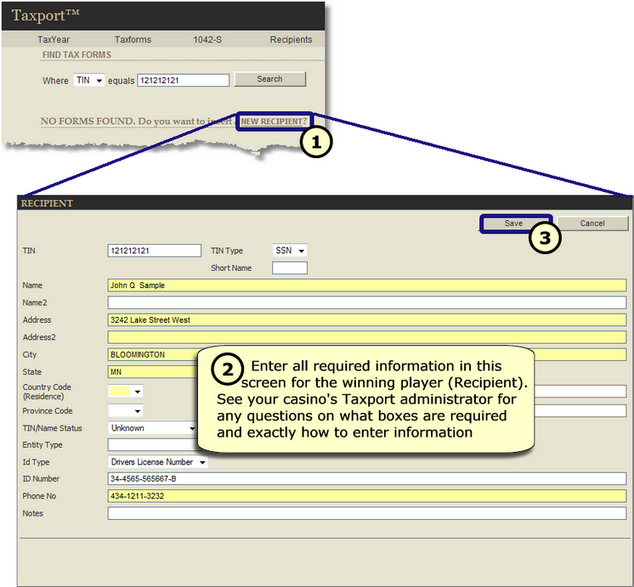

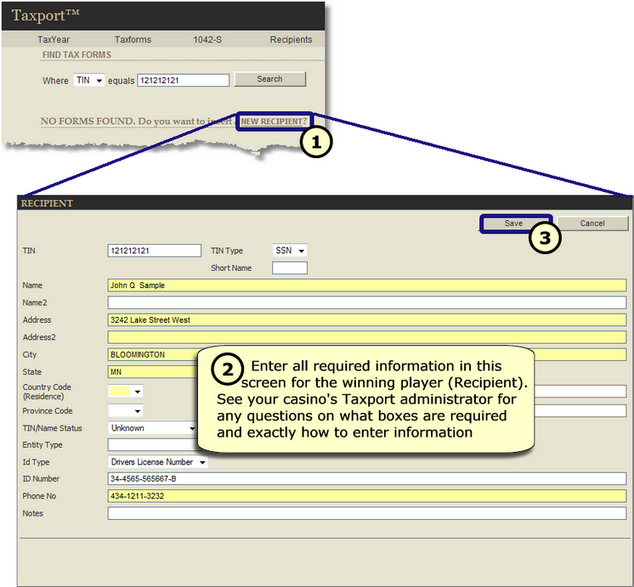

| Step 1: | If the player has NOT previously been entered into Taxport, a new screen that is similar to the one below will appear when you click on the "NEW RECIPIENT" link circled in the screen example directly below. |

Note: Note: | If the player has NOT previously been entered into Taxport and the player is a foreigner and you have clicked on the "1042-S" link "Lookup Forms", the link will instead read, "NEW 1042 RECIPIENT".

|

| Step 2: | A new screen will display that is similar to the one shown above (1042-S Recipients will have specific boxes for foreigner information). Enter all required information in this screen for the winning player (Recipient). |

Tip: Tip: | See your casino's Taxport administrator or manager for any questions on what boxes are required and exactly how to enter information. |

Note: Note: | If the data that you type into these fields contains non-compliant information, you may get an error message that will prompt you to re-type compliant information. For instance, if you try to enter a letter in the zip code field, you will receive an error message. |

| Step 3: | Click on the "Save" button. You will then need to wait a few moments while Taxport Casino performs a TIN and OFAC Verification (not applicable to 1042-S foreigners). While waiting, you should not click on "Save" again or any other links (the status bar will indicate that the record is processing). |

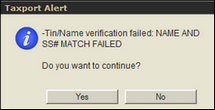

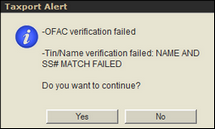

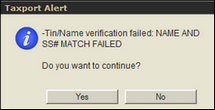

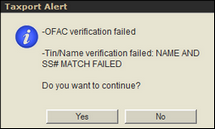

| Step 4: | After waiting a few moments, if you get a "Taxport Alert" message similar to the ones shown below, proceed to the topic, "TINs and OFAC Verification" before continuing on with Step 5 below. Otherwise, if a "Taxport Alert" is not displayed, proceed to Step 5 below.

|

Step 5: Return to Step 3 in the previous topic, "Entering Player TIN".

Main Menu Main Menu

Home Menu Home Menu

|