|

Whenever you click on the "Save" button when entering player information or entering a new tax form record, Taxport Casino checks the player's information for two things:

| Whether the player's TIN and Name combination matches what the IRS currently has on file for that individual. |

| Whether the player's provide information (including but not limited to TIN and Name) is on any "OFAC" list. For instance, if the player was a known terrorist (for more information about OFAC, click on the following link). |

Note: Note: | Your particular Taxport Casino setup may not include the OFAC check. Contact your Convey "Implementation Consultant" if you have questions or wish to configure your particular setup in a certain manner. |

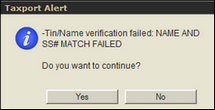

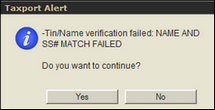

You will need to wait a few moments while Taxport Casino performs this check (the TIN and Name check does not occur for 1042-S foreigners). If you get a "Taxport Alert" message similar to the ones shown below, proceed as follows below.

Tin and Name Combination Verification:

If the TIN and Name combination cannot be verified against existing IRS information, a "Taxport Alert" will display with a "Tin/Name verification failed ..." message included. You can choose from two options:

Note: Note: | Your next choice of the "Yes" or "No" buttons depend on your particular casino policies. See your casino's Taxport administrator or manager if you have questions. |

| You can click on "No" and attempt to determine the correct TIN and name information from the winning player. You can then make changes to the player information (Recipient) screen and re-save the changed information until this "Taxport Alert" does not appear. |

| You can click on "Yes" to ignore this Alert and continue to work with the provided TIN information. Depending on your casino's particular Taxport Casino setup, this may have ramifications as to how much is calculated in the "Federal Income tax withheld" box and resultant "Cash Amount" box. The Internal Revenue Code stipulates certain actions for recipients (or in this case, players) with missing TINs, incorrect name/TIN combinations, and/or not currently issued TINs. |

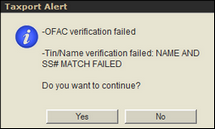

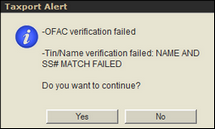

OFAC Verification:

Note: Note: | Your particular Taxport Casino setup may vary from the below description. Contact your Convey "Implementation Consultant" if you have questions or wish to configure your particular setup in a certain manner. |

If the player triggers a predetermined level on the OFAC check (as determined by your Casino), a "Taxport Alert" will display with a "OFAC verification failed" message included (as shown in the screen example above). Your choice of the "Yes" or "No" buttons depends on your particular casino policies.

| If "No" is chosen, the player information and/or the new tax form record will not be entered into Taxport Casino. It will essentially cancel the transaction and nothing further will happen. See your casino's Taxport Casino administrator or manager if you have questions as to your next actions. |

| Typically, Taxport Casino is setup so that when a "Floor or 'Cage" employee user chooses "Yes" in response to an "OFAC verification failed" message, the "OFAC Status" field on the player information (Recipient) screen will automatically be set to "Review Pending" and will typically have ramifications as to how much is calculated in the "Federal Income tax withheld" box and resultant "Cash Amount" box on the Tax Form (all winnings may be withheld). Certain Taxport Casino users (usually "Floor Managers") have the ability to change OFAC box Status. Your next actions depend on your particular casino policies. See your casino's Taxport Casino administrator or manager if you have questions as to your next actions. |

Main Menu Main Menu

Home Menu Home Menu

|